Microsoft-Based Financial Management Solutions

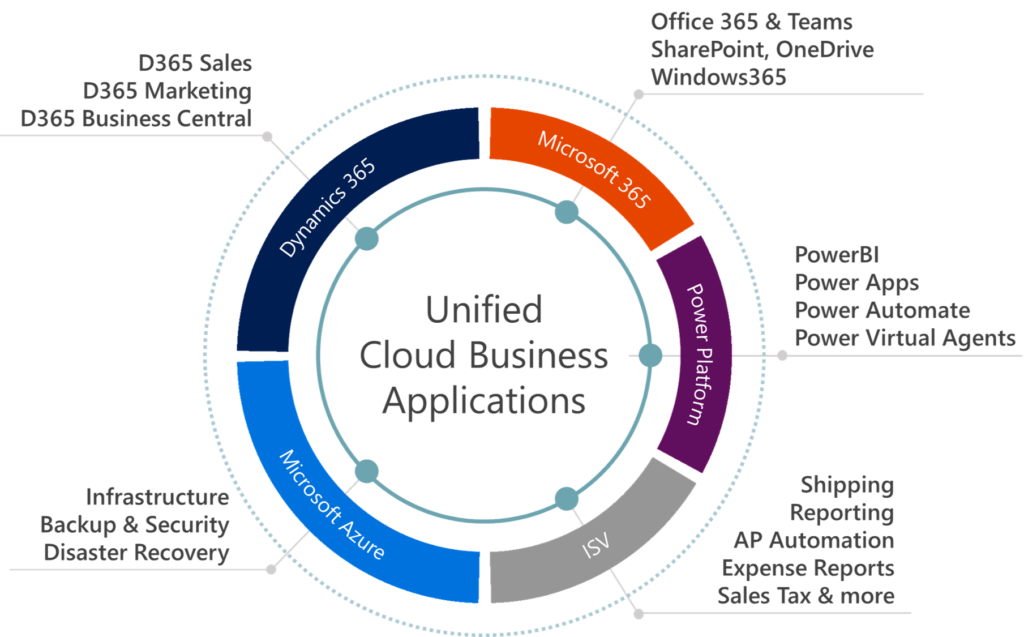

MP-365 specializes in financial management solutions built on the Microsoft 365 platform. We design SharePoint portals, Dynamics 365 CRM systems, Power BI dashboards, and Power Platform workflows tailored for finance teams in banking, insurance, manufacturing, and other industries. Our unified Microsoft solutions break down data silos and streamline finance operations. For example, Power BI can consolidate disparate financial data into a single source of truth, moving organizations away from disconnected spreadsheets. By integrating SharePoint with Dynamics 365, a client was able to access all project documents directly from CRM—creating a fully functional, stable system for document management. MP-365’s services give decision-makers a 360° view of finances, enabling faster, data-driven decisions.

Common Challenges: Finance teams often struggle with fragmented processes. Departments rely on tedious email chains and spreadsheets, leading to repetitive, error-prone work. Uncoordinated contract approvals and manual procurement slow down operations. Legacy CRM and ERP systems leave each business unit in its own silo – “collaboration between business units [is] difficult” and executives lack a unified view of customer relationships. Regulated industries face additional pressures: compliance and audit reporting demand consistent processes and detailed audit trails. Manual processes make audits costly and increase the risk of missed controls.

SharePoint for Finance Teams: Portals & Document Management

MP-365 uses Microsoft SharePoint to create centralized finance portals and collaboration hubs. These sites serve as secure “one-stop” intranets where investment advisers, accountants, and insurance underwriters can access the latest reports, templates, and contracts. We migrate legacy file shares and emails into SharePoint libraries with robust search and metadata tagging. This dramatically improves collaboration: one financial advisory firm gained a unified portal that let employees “search and access documents they need…quickly and easily,” while enforcing access permissions for regulatory compliance. SharePoint Team Sites, combined with Microsoft Teams and Planner, automate project and task management – replacing endless email threads. Key capabilities include:

- Advisory Portals & Intranets: Custom portals for client engagement, regulatory updates, and team collaboration.

- Document Migration & Controls: Move contracts, licenses, and purchase agreements into SharePoint. Set permission levels so sensitive files are only seen by authorized roles, ensuring compliance.

- Knowledge Sharing: Department pages and wikis (e.g. Accounting, Risk, IT) organize policies and best practices, reducing duplicated effort.

- Collaboration Integration: Built-in Office 365 integration (Teams chat, Planner tasks) means finance and business teams work together on a consistent platform.

These SharePoint solutions eliminate the common problem of inefficient collaboration. As one case noted, lack of a centralized system “caused the Client’s employees [to] waste much time on simple repetitive tasks”. By contrast, our SharePoint portals put all stakeholders on the same page, cutting processing time and errors

Microsoft CRM for Financial Services & Insurance

Dynamics 365 CRM (Sales, Customer Service, etc.) is the foundation for streamlined client and sales management. MP-365 configures Dynamics 365 to track financial opportunities, policy sales, service cases, and contract lifecycles. We tailor the system for financial services and insurance workflows – for example, automating insurance quoting, managing client portfolios, and linking contracts to transactions. A unified CRM replaces fragmented legacy systems: one insurance firm that consolidated three separate CRMs onto Dynamics 365 gained a 360° client view and eliminated duplicate data. Business units can now collaborate on cross-sell opportunities and see all client interactions in one place.

Key features include:

- Sales & Relationship Management: Manage leads, opportunities and renewals for banking or insurance products. Dynamics 365 provides dashboards for pipeline and revenue forecasts.

- Customer & Contract Service: Track service requests, policy details, or loan performance. Contracts and loan documents can be stored in SharePoint and surfaced in CRM (as in the case above).

- Financial Workflows: Automate approvals for budgets, credits, or vendor contracts within the CRM. For instance, Dynamics 365 can initiate a Power Automate flow when a contract is uploaded, routing it for approval based on predefined rules.

- Compliance Controls: Built-in audit logs and role-based security ensure that sensitive financial data (like KYC/AML or SOX-related records) is handled according to corporate policies.

By leveraging Microsoft’s cloud CRM, organizations avoid unstable legacy platforms. A unified Dynamics 365 deployment brings together sales, customer service, and finance teams – “improv[ing] relationship management” and “better collaboration between business units”. MP-365 ensures each implementation is stable, scalable, and fits with your reporting and regulatory needs.

Power BI for Financial Reporting & Forecasting

MP-365 builds Power BI dashboards that turn finance data into actionable insights. These interactive dashboards feed from multiple sources (ERP, CRM, spreadsheets) and present real-time KPIs to executives and managers. Power BI is especially powerful for visibility and planning in finance – it “streams data from disparate systems into a cohesive single view,” reducing reliance on disconnected spreadsheets. CFOs can instantly see trends, drill into budget vs. actuals, and even run predictive forecasts. For example, a predictive analytics dashboard can highlight variances between forecasted plans and actual performance.

Typical Power BI solutions include:

- Consolidated Financial Dashboards: Profit & Loss, Balance Sheet, and Cash Flow reports with drill-down by business unit or project.

- Budget vs. Actual Analysis: Automatic charts showing expenses or revenue vs. plan, highlighting overages and efficiencies.

- Forecasting and Scenario Modeling: Use Power BI’s machine learning or “what-if” parameters for predictive budgeting. It lets finance teams perform “complex modeling with help from Microsoft’s advanced AI capabilities”.

- Executive Scorecards: Key metrics (e.g. net margin, invoice aging, liquidity) delivered in real-time. Alerts and data-driven subscriptions notify CFOs when thresholds (like budget variances) are exceeded.

These dashboards empower decision-makers. By translating raw financial data into clear visuals, Power BI helps analysts spend less time “answering questions and more time on actual forecasting, planning and analysis”. In practice, clients can automate report refreshes so that every morning the latest figures are in hand.

Power Platform Workflows for Finance Automation

To eliminate manual bottlenecks, MP-365 leverages Microsoft Power Automate (and Power Apps) to automate finance and procurement processes. Traditional finance departments face tedious tasks – repetitive data entry and approvals that are “labor-intensive and error-prone”. We design low-code flows that enforce business rules, route requests, and maintain audit trails. Key automation scenarios include:

- Invoice & Expense Processing: A common solution is an AP workflow where Power Automate extracts invoice details, performs a three-way match against purchase orders, and automatically routes the invoice for approval. Upon approval, the payment is scheduled and financial records updated – all without manual re-entry. This accelerates invoice processing and even captures early payment discounts.

- Budget & Purchase Approvals: Managerial approval chains are digitized. An employee can submit a budget or purchase request via a Power Apps form, and Power Automate ensures it goes to the right approvers based on amount and department. This “ensures requests are routed according to spending limits and managerial hierarchy,” eliminating lost paperwork.

- Reporting & Notifications: Flows aggregate data for monthly reporting. For example, one flow might gather trial balance figures from ERP and send a consolidated report to finance each morning. Another could refresh Power BI dashboards and immediately notify stakeholders when new figures are available. Real-time alerts in Teams or email keep the entire finance team on schedule during month-end closes.

- Compliance & Audit Logs: Every automated process is logged. Power Automate’s detailed logs and the Microsoft Purview compliance portal make it easy to demonstrate that every step was followed – a huge benefit in regulated sectors. Automated compliance checks reduce risk: “the likelihood of human oversight errors diminishes” when flows handle tasks consistently.

Implementing these workflows yields rapid ROI. Studies show Power Automate investments can pay back “within months” due to time savings. In practice, our clients report dramatically lower manual errors and faster cycle times. For instance, one client saw invoice approvals that used to take days now complete in hours thanks to automated reminders and routing.

Delivering Business Impact with MP-365

Across industries, MP-365’s Microsoft solutions deliver measurable value. Finance leaders gain:

- Enhanced Collaboration: Unified portals and CRM eliminate siloed data. Teams spend less time searching for files, as one case noted, and more time on analysis.

- Improved Accuracy: Automation reduces common errors. As Gartner notes, many finance leaders turn to automation to eliminate manual work. Automated workflows dramatically cut invoice processing time while maintaining full audit visibility.

- Greater Agility: Real-time Power BI insights and streamlined workflows enable faster decision-making. Finance executives can adjust forecasts on the fly and keep up with market changes.

- Scalability & Compliance: Cloud-based Dynamics 365 and Power Platform grow with your business and include built-in security. Advanced audit trails and permissions mean you can meet strict regulatory requirements without cumbersome manual effort.

MP-365 brings deep Microsoft expertise to every engagement. Our consultants understand finance and compliance, and tailor each solution to your needs – whether you’re a regional bank, an insurer, or a manufacturing company with embedded finance teams.

Ready to transform your financial operations?

Contact MP-365 today to learn how our Microsoft-based financial management solutions can accelerate your workflows, improve insight, and ensure compliance.

Contact Us